us capital gains tax news

Unlike the long-term capital gains tax rate there is no 0 percent rate or 20. Ad Get the Ultimate In Financial News and Analysis With Bloomberg.

Can Capital Gains Push Me Into A Higher Tax Bracket

Get Access to the Largest Online Library of Legal Forms for Any State.

. The proposal may affect a relatively small number of investors but planning now is wise. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. Long-Term Capital Gains Taxes.

That applies to both long- and short-term capital gains. Therefore the top federal tax rate on long-term capital gains is 238. State and local taxes often apply to capital gains.

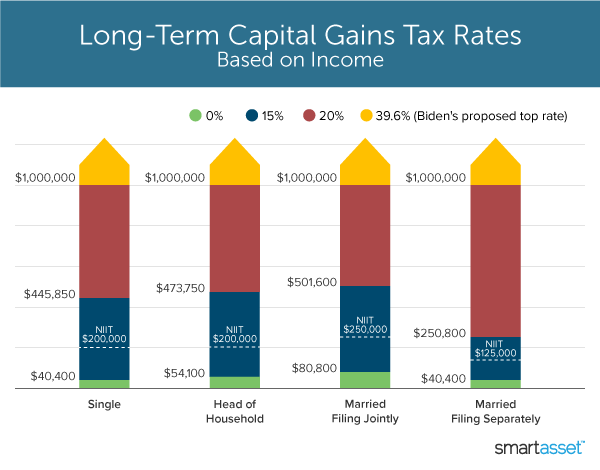

The proposed legislation would among other things significantly expand the scope of Section 1061 1. Free easy returns on millions of items. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widower.

Preckwinkle announces loan program for towns and schools that need those revenues to operate. Capital Gains Tax News. Biden is proposing that Congress raise the top tax rate on capital gains from 20 to 396.

Senate Majority Leader Chuck Schumer D-NY and Sen. The bottom 99 on. Latest US News Hub.

Late property tax bills in Cook County will be due by years end. Capital Gain Tax Rates. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion.

Latest news on Capital Gains Tax in the United States where individuals and corporations pay US federal income tax on the net total of all their capital gains. Hawaiis capital gains tax rate is 725. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Data news and analytics through innovative technology. Passed by the Senate in March in another narrow vote Engrossed Substitute Senate Bill 5096 would impose a new 7 tax on certain capital gains income including profits from selling long-term. On July 27 2022 US.

It was announced that long-term capital gains beyond Rs 1 lakh from stocks equity funds. Some states structure their taxes differently. Capital Gains Tax News.

Major income tax changes in last 10 years and how they have impacted your investments. Youll owe either 0 15 or 20. Americans are facing a long list of tax changes for the 2022 tax year.

Free shipping on qualified orders. Latest news headlines analysis photos and videos on Capital Gains. The bottom 99 on.

The White House will this week propose nearly doubling taxes on capital gains to 396 for people earning more than 1 million Reuters and. Immigrants with a Temporary Residency Permit can now file the I-765 job application online Latest US News Hub. Why should there be a globally mandated tax rate.

News about Capital Gains Tax including commentary and archival articles published in The New York Times. The Democrats are also proposing to add a 3. The proposal called the billionaires minimum income tax would require that taxpayers worth more than 100 million pay a minimum of 20 on their capital gains each year regardless of whether.

Smart taxpayers will start. The new top rate combined with an existing 38 surtax on investment income over certain thresholds. Relevance is automatically assessed.

Long-term capital gains tax on stocks. Joe Manchin D-WVa announced an agreement to add the Inflation Reduction Act of 2022 to the FY2022 budget reconciliation bill and vote in the Senate next week. The highest long-term capital gains rate would rise to 25 while the 38 Medicare surcharge for high-income investors would push that rate to 288.

Short Term Capital Gains Tax. The new top rate combined with an existing 38 surtax on investment income over certain thresholds. One of the changes announced was in April 2018.

There is currently a bill that if passed would increase the. Capital gains tax rates on most assets held for a year or less correspond to. Advisors Eye Capital Gains Tax Changes.

Advisors Eye Capital Gains Tax Changes. The tax rate on most net capital gain is no higher than 15 for most individuals. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

The first thing you need to know about capital gains tax is that they come in two flavors. The US is again trying to bully other countries to tow its line. Ad The Leading Online Publisher of National and State-specific Legal Documents.

In a state whose tax is stated as a percentage of the federal tax liability the percentage is easy to calculate. FBI Asks About 2019 Allegations. Read all the latest news on Capital Gains Tax.

The top 01 a group of just 120000 people earning an average of more than 11 million a year earned more than half of all capital gains income in the United States in 2019. This feed updates continuously 247 so check back regularly. Long-term isnt really.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Tax Changes and Key Amounts for the 2022 Tax Year.

Capital Gains Tax What Is It When Do You Pay It

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

What S In Biden S Capital Gains Tax Plan Smartasset

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Biden Wants To Limit The Capital Gains Tax Preference History Shows It Will Be Hard

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Tax Advice News Features Tips Kiplinger

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)